Mastering Efficiency:

Exploring the World of Virtual Tax Preparation Services

In today's ever-changing financial landscape, the traditional methods of tax preparation are making way for more efficient and accessible solutions. Virtual tax preparation services have become a cornerstone in managing financial responsibilities for both individuals and businesses.

This means that your CPA can deliver your tax returns directly to you, on your schedule, to your inbox, and with the peace of mind that your documents are secure. This blog will be your guide to understanding the ins and outs of virtual tax preparation by focusing on practical benefits, strategies, and essential considerations.

Let's explore how virtual tax preparation is making a monumental impact on businesses and individuals. We'll highlight the straightforward advantages and technology-driven solutions that are making this approach increasingly popular. Whether you're a hard-working individual, self-employed, a business owner, or just someone looking for efficient ways to handle tax responsibilities, this page is here to help you understand and embrace the transformative influence of virtual tax preparation services.

Join us as we break down the steps of virtual tax preparation, emphasizing the tangible advantages that redefine how we approach tax compliance in today's tax landscape.

Table of Contents

- What is Tax Preparation and Why Does it Matter?

- Methods for Preparing a Tax Return Virtually

- How Does Barklee Financial Group Prepare Tax Returns Virtually?

- Tax Prep Checklist

- Our Guide on How to Vet and Hire a Virtual Tax Preparer

- Considerations for Choosing a Virtual Tax Preparer

- What Are the Pros and Cons of Virtual Tax Preparation?

- Tips and Tricks for Working with a Virtual Tax Preparer

- Is it Safe to File Taxes Online?

- More Resources for Virtual Tax Preparation + How to Schedule a Conversation

Now, let's dive in!

What is Tax Preparation and Why Does it Matter?

So, here's the thing: in the past, tax preparation used to be all about collecting stacks of paperwork, spending endless hours on tax forms, and making trips to actual tax preparation offices.

Virtual tax preparation is a modern and user-friendly way of getting your taxes done without the need for face-to-face interactions. Instead of physically visiting a tax professional's office, you can use online platforms and software to gather, organize, and submit your financial information. This process allows you to upload documents, answer questions, and receive guidance—all from the comfort of your own home, or while you are busy running your company meetings.

Methods for Preparing a Tax Return Virtually

Virtual tax preparation services leverage technology to streamline the entire tax filing procedure, making it more convenient for individuals and businesses alike. Whether you're a freelancer with diverse income sources or a small business owner navigating various deductions, virtual tax preparation offers an accessible and efficient solution to meet your tax obligations without the need for extensive paperwork or in-person appointments.

Virtual tax preparation uses various methods and tools to make filing taxes easier and more efficient. Let's take a look at a couple of notable methods:

Virtual Tax Organizer

Many virtual tax preparation services provide clients with a virtual tax organizer.

This online questionnaire or checklist serves as a valuable tool for individuals and businesses to gather and streamline their financial information for tax purposes. Through a secure online portal, users can input details about their income, expenses, deductions, and other pertinent financial data.

This efficient and organized approach ensures accuracy and ease in tax preparation. As well as, the virtual tax organizer ensures that important information is systematically collected, making the tax preparation process smoother and more organized.

In addition, virtual tax organizers should automatically create digital records that can be stored by the tax preparer for future reference by both the client and the preparer’s team.

Electronic Document Signing (e.g., DocuSign)

Every tax return must possess the taxpayer’s signature in wet or digital form. Electronic signature platforms like DocuSign play a crucial role in virtual tax preparation.

Instead of dealing with physical paperwork and manual signatures, individuals and tax professionals can use secure electronic signatures to sign and submit important tax documents. This not only expedites the process but also enhances the security of sensitive information.

DocuSign, among other similar platforms, enables users to electronically sign and exchange tax-related documents, reducing the need for printing, scanning, and mailing physical papers.

Electronic Tax Filing (E-Filing)

Electronic tax filing, or e-filing, is a fundamental method in virtual tax preparation. This process allows individuals and businesses to electronically submit their tax returns to government tax authorities, such as the Internal Revenue Service (IRS) in the United States.

Virtual tax preparation software often incorporates e-filing, allowing users to securely and efficiently transmit their completed tax forms. E-filing not only speeds up the submission process, but also minimizes the chances of errors as the software performs necessary calculations and checks prior to submitting the return.

Cloud-Based Accounting Software

Utilizing cloud-based accounting software is another method in virtual tax preparation. Platforms like QuickBooks, Xero, or FreshBooks allow users to manage their financial records, track expenses, and generate financial reports throughout the year.

During tax season, sharing this data with tax professionals becomes a breeze, ensuring an effortless yet precise preparation process. Imagine this: no more printing or emailing your statements!

By adding your tax professional to your online accounting software, they can effortlessly fetch your financial statements like balance sheets and profit and loss statements. Say goodbye to manual delivery and hello to a more streamlined tax return experience for small businesses + individuals.

Virtual Meetings and Consultations

Face-to-face meetings are still vital when dealing with taxes and financials. Virtual tax preparation solves this priority with the use of video conferencing tools for meetings and consultations between taxpayers and tax professionals.

Through platforms like Zoom and Teams, individuals can discuss their financial situation, ask questions, and receive personalized advice from tax experts—all without the need for in-person appointments.

This means that you get to meet and interact with your tax professional on your time and in your way.

These methods collectively create a comprehensive and streamlined virtual tax preparation experience. They provide individuals and businesses with the flexibility and convenience to effectively manage their tax obligations in an ever-evolving digital world.

How Does Barklee Financial Group Prepare Tax Returns Virtually?

Increasing your net worth and decreasing your tax liability does not have to come with the sacrifice of your time and data security. Therefore, Barklee Financial Group has put together a suite of industry-leading cloud-based tools that help every player achieve their goals during tax time.

Let’s discuss the methods and processes that we use to manage your tax documents and prepare your tax return virtually.

Secure, cloud-based document delivery

You will be provided with a secure client portal that allows you to upload your documents straight to our office without using email which is not secure and hacker-prone.

Your portal will be assigned to your email address of choice and provide you with a secure online vault. We will exchange documents back and forth through this vault. In addition, we will store all prior year documents in this vault so that you can access them at any time.

Finally, we will provide your tax return for approval via the portal and our email-based task list. This means that a PDF copy of your return is securely retrievable by you where you need it to be and when you need it to be.

Checklist-based email reminders and document requests

You need reminders and alerts on your time and in your inbox, and our cloud-based project management system will do just that.

When we send you a tax organizer, you'll receive a checklist-based task list right in your inbox. This handy list shows you what you've provided and what's still needed. You can simply check off the items you've completed. Easy peasy!

Comments and questions can be added directly to each task item and document request. In addition, you can open your secure portal for direct email uploading right inside of the checklist. Once your list is complete, the system will alert our team that you are ready for us to prepare your tax return.

Stay ahead of the tax season stress and ensure you're fully prepared with Barklee's Tax Preparation Checklist - your essential guide to navigating the tax preparation process with confidence and ease.

Electronic filing authorization signed by DocuSign

In the old days, a trip to the tax office was required in order to receive your tax return, sign it, and mail it to the IRS.

Those days have been replaced by virtual e-signature and approval methods. Barklee employs the leading secure e-signature collection service, Docusign, to securely collect your signature through Knowledge Based Authentication methods via email.

Then, you'll review your tax return and approve the submission to the IRS by digitally signing your Form 8879, or other. The system generates a copy of the signature for our files and allows us to eFile your return straight to the IRS from our software.

Electronic Filing of your Tax Return to the IRS

Gone are the days of needlessly and inefficiently filing paper tax returns. The IRS now mandates that most tax returns, for both individuals and businesses, be submitted electronically through eFile. This secure system, established by the IRS, is readily accessible through our tax preparation software.

Once we receive your signed Form 8879, approving your tax return, we promptly eFile it on your behalf.

Direct Deposit of your refunds and liabilities

Although we never want to sacrifice security, we all know that financial payments and money transfers are going completely digital.

At Barklee, we secure your authorization to request a direct deposit of your refund from the IRS by ACH methods. This means that you do not have to wait for a check to arrive in the mail before utilizing your tax refund.

Still not comfortable with direct deposit and handing out your bank account credentials? Not to worry, we will request the IRS provide all refunds, receive all liability payments by mail, and provide you instructions on how to do so.

Face-to-face tax projections, reviews, and consultations by video chat

Just because you cannot sacrifice the time to travel to your CPA’s office for an hour-long appointment doesn’t mean you have to forfeit the value of a face-to-face conversation about your tax situation.

Our team utilizes a variety of video and voice chat platforms, including Zoom, Teams, and more, to connect with you. Schedule your virtual appointment now and select your preferred method of contact. We look forward to chatting with you!

Our Guide on How to Vet and Hire a Virtual Tax Preparer

Virtual tax preparation is exciting! By rescuing your time and streamlining the laborious tax preparation process, it brings efficiency to the table. As a result, hiring a virtual tax preparer has become an appealing option for both individuals and businesses.

However, convenience comes with the responsibility of ensuring that the chosen professional possesses the necessary expertise and reliability for accurate and secure tax preparation.

Below, we will explore the essential criteria to evaluate, key questions to ask, and vital considerations to keep in mind when vetting and hiring a virtual tax preparer.

Download Barklee's Comprehensive Guide on How to Vet and Hire a Virtual Tax Preparer, ensuring you entrust your financial future to a reliable and skilled professional who can help maximize your refund and minimize your stress.

Understanding Your Tax Needs

Before diving into the process of hiring a virtual tax preparer, it's crucial to have a clear understanding of your tax needs. Consider the complexity of your financial situation, the type of income you earn, and any specific deductions or credits that may apply. Consider the types of returns you and/or your business are required to file. This includes the schedules inside each return, and the information they possess and require to complete.

You will need this information so that both you and your prospective tax preparer can determine if they have the ability, the skills, and the virtual process established to accurately and efficiently prepare and file your returns.

At Barklee Financial Group, each of our clients start with a 15-30-minute interview through your chosen contact method. This time together allows you to gather information about our character and integrity, our processes, and our fees and requirements. It also allows our firm time to understand exactly what your tax preparation needs are so that we can properly assess our ability to meet your needs.

After this appointment, should we choose to move forward with each other, you will receive a detailed engagement outlining our fees, processes, and commitment to each other.

The first step in determining in considering your personal needs is to ask yourself if you are looking for a CPA who specializes in tax strategies that increase your net worth and reduce your tax liability all while providing services to you virtually. If this is you, let’s talk.

Schedule your virtual appointment here!

Credentials and Qualifications

When vetting virtual tax preparers, always prioritize their credentials and qualifications. Look for professionals who are Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys.

These designations indicate a high level of expertise and adherence to ethical standards. Additionally, check if the preparer stays updated with tax laws and regulations through continuous education and professional memberships.

Barklee is a team of CPAs, educated accountants, and tax professionals. We regularly engage in continuing education provided by the industry’s leading organizations and education companies including the American Institute of Certified Public Accountants, Thomson Reuters Continuing Education, Texas Society for Certified Public Accountants, and many others.

Experience in Your Industry

Consider the virtual tax preparer's experience in handling tax matters specific to your industry. Tax implications vary across professions and sectors, and having a preparer familiar with the intricacies of your field can ensure a more accurate and efficient tax preparation process.

At Barklee, we specialize in serving:

- self-employed individuals

- service-based franchise companies

- and veterinary clinics.

We offer a carefully curated range of services, including cloud-based accounting, modern payroll solutions, financial projections and analysis, as well as tax strategies and preparation. Our goal is to provide tailored support to help you excel in your business endeavors.

Technology Proficiency

When choosing a tax preparer for virtual tax preparation, it is crucial to evaluate their proficiency with tax software, cloud-based accounting tools, and secure document-sharing platforms. A tax professional who is adept in technology can streamline the process and facilitate effective communication throughout the engagement.

However, technology should never get in the way of efficiency, accuracy, and meeting your needs right where you're at. And hey, the firm you choose shouldn't be constantly changing their methods either. I mean, who wants to keep learning new software, creating new login credentials, and always searching for prior year's data, right?

At Barklee, we employ a suite of industry-leading cloud-based solutions provided by Intuit, Bill.com, Microsoft, Adobe, and SmartVault which are well-established and reputable companies that are not going anywhere fast.

Check Out Client Testimonials and Reviews

To effectively assess the competence and dependability of a virtual tax preparer, it is advisable to review client testimonials and online feedback. Platforms such as Yelp, Google Reviews, or the preparer's website can offer valuable insights into the experiences of past clients.

It is important to focus on comments regarding accuracy, responsiveness, and overall satisfaction. By paying attention to these factors, one can make an informed decision when choosing a tax preparer.

Check out what our clients are saying about us!

Verify Professional Liability Insurance

Professional liability insurance is essential for protecting both you and the tax preparer in the event of errors or omissions during the tax preparation process. It is important to ensure that the virtual tax preparer has adequate insurance coverage to mitigate any potential risks.

At Barklee, we firmly believe that such risks should not be entrusted to generic insurance companies that lack specialization in our industry and fail to serve our customers effectively.

That's why we foster relationships with local insurers who understand our company, comprehend our customers' needs, + offer exceptional coverage.

Fee Structure and Transparency

Before engaging a virtual tax preparer, it is crucial to have a clear understanding of the fee structure. Take the time to comprehend how fees are determined, whether they are based on the complexity of the return, hourly rates, or a flat fee.

Additionally, seek transparency regarding any additional charges for specific services. By clarifying the costs upfront, you can avoid any surprises later in the process.

After your initial interaction with Barklee, you will receive an engagement contract via email. This contract will guide you through our process, outline the details of our services and commitment to you and your taxes, and specify our requirements for each client.

Finally, we'll send you a detailed quote of our services, including all the costs and fees. Take your time to carefully consider your decision. When you're ready, just sign our engagement digitally and choose a payment method. It's really that simple!

Availability and Communication

Effective communication is essential for a successful virtual tax preparation experience.

- Ensure that the tax preparer is accessible and responsive to inquiries.

- Discuss the preferred mode of communication, whether it's email, phone calls, or video conferencing, and confirm their availability during key phases of the tax season.

You get to schedule an appointment with a Barklee tax professional at any time by navigating to our website and using the appointment link, or simply by clicking here!

IT Security

Due to the sensitive nature of tax information, ensuring security is paramount. When selecting a virtual tax preparer, it is vital to inquire about their security measures in place to safeguard your data. Look for professionals who utilize encrypted communication channels, secure file-sharing platforms, and adhere to best practices for data protection.

Ask About the Review Process

Gaining an understanding of the preparer's review processes can offer valuable insights into the level of thoroughness applied to their work. It is important to inquire about the specific steps they undertake to meticulously review your tax return for accuracy and compliance. A comprehensive review process significantly contributes to the overall reliability of the tax preparation.

At Barklee, our team of tax professionals is here to take care of everything related to your tax return. We draft, prepare, review, and evaluate your ending tax return to customize the best tax strategies based on your specific needs.

Yes, you heard it right! While we handle your tax return, we also implement tax strategies that are available to your business or individual return. We believe in reducing your tax liability, even when you may not be aware of it. So, rest assured that we've got you covered!

Discuss Record Retention Policies

Make sure you know how long the virtual tax preparer keeps your records. Confirm their secure storage and ask about accessing records in the future, especially for audits or financial inquiries.

Barklee Financial Group, LLC retains client records indefinitely. Even if you choose to switch to a new tax preparer, we will continue to maintain your records. There may be costs associated with accessing certain types of records, but we will also return any records that you provide to us.

Request an Engagement Letter

An engagement letter is a detailed document that outlines the terms and conditions governing the professional relationship between you and the tax preparer. It's advisable to request a sample engagement letter to review the scope of services, fees, responsibilities, and other important details. This document serves as a crucial point of reference, ensuring clarity and transparency throughout the engagement.

As mentioned in the previous fee discussion, Barklee will promptly provide you with a tailor-made engagement that caters to your specific tax situation, filings, and requirements. This engagement will encompass all known fees associated with the services we discussed during our interview.

Additionally, it will outline the contractual agreements established between you and our firm, as well as our mutual commitments. Once you digitally sign the engagement, you will receive a signed copy for your records.

Evaluate Proactive Tax Planning

A proactive tax preparer goes beyond the current year's tax return and takes into account future tax implications. It is important to inquire about their tax planning approach and whether they offer guidance for optimizing financial decisions to maximize tax efficiency.

We refer to them as tax advisory meetings, while you may know them as tax projection meetings. Regardless of the terminology, our goal is to discuss your upcoming tax situation proactively. To ensure we have ample time, it's important to schedule an appointment well before the year-end and gather your year-to-date income information. During our hour-long conversation, we will delve into your projected tax liability and explore strategies to minimize it not only for this year, but also for the years to come.

Tax advisory meetings are just one of the many ways we go above and beyond to serve individuals and business owners. Our tax strategies services are designed to help you navigate the complex world of taxes with ease.

Check for Red Flags 🚩

During the vetting process, it's important to stay vigilant for any red flags that may arise. These could range from a lack of transparency regarding fees, evasive answers to your questions, or negative reviews from previous clients. It's crucial to trust your instincts and address any concerns that come up by seeking clarification.

At Barklee, only sign your engagement if you are confident in your decision and what we will provide. Rest assured; we won't deliver an engagement unless we are confident in delivering excellent tax preparation services to you too.

Compare Multiple Candidates

To find the perfect virtual tax preparer, consider exploring multiple options. Request quotes, compare services, and assess each candidate's overall impression. A comprehensive comparison will help you make an informed decision and find the best fit for your needs.

Yes, we definitely encourage it! Just want to assure you that we're fully aware that our services come at a premium. The reason behind this is that you're not just hiring a regular tax professional to simply record your data and e-file your tax return. Instead, you're building a relationship with a Certified Public Accountant who will work on your behalf to boost your net worth and minimize your tax liability.

And the best part? We provide all these services to you virtually. So, you can count on us to deliver top-notch results while working together!

Don't leave your taxes to chance; download Barklee's Comprehensive Guide on How to Vet and Hire a Virtual Tax Preparer, ensuring you entrust your financial future to a reliable and skilled professional who can help maximize your refund and minimize your stress.

When it comes to hiring a virtual tax preparer, taking a diligent and informed approach is crucial. By prioritizing qualifications, experience, communication, and security measures, you can locate a professional who not only meets your immediate tax needs but also contributes to your long-term financial well-being. Keep in mind that a thoroughly vetted virtual tax preparer can serve as a valuable asset in confidently navigating the complexities of tax compliance, providing you with peace of mind.

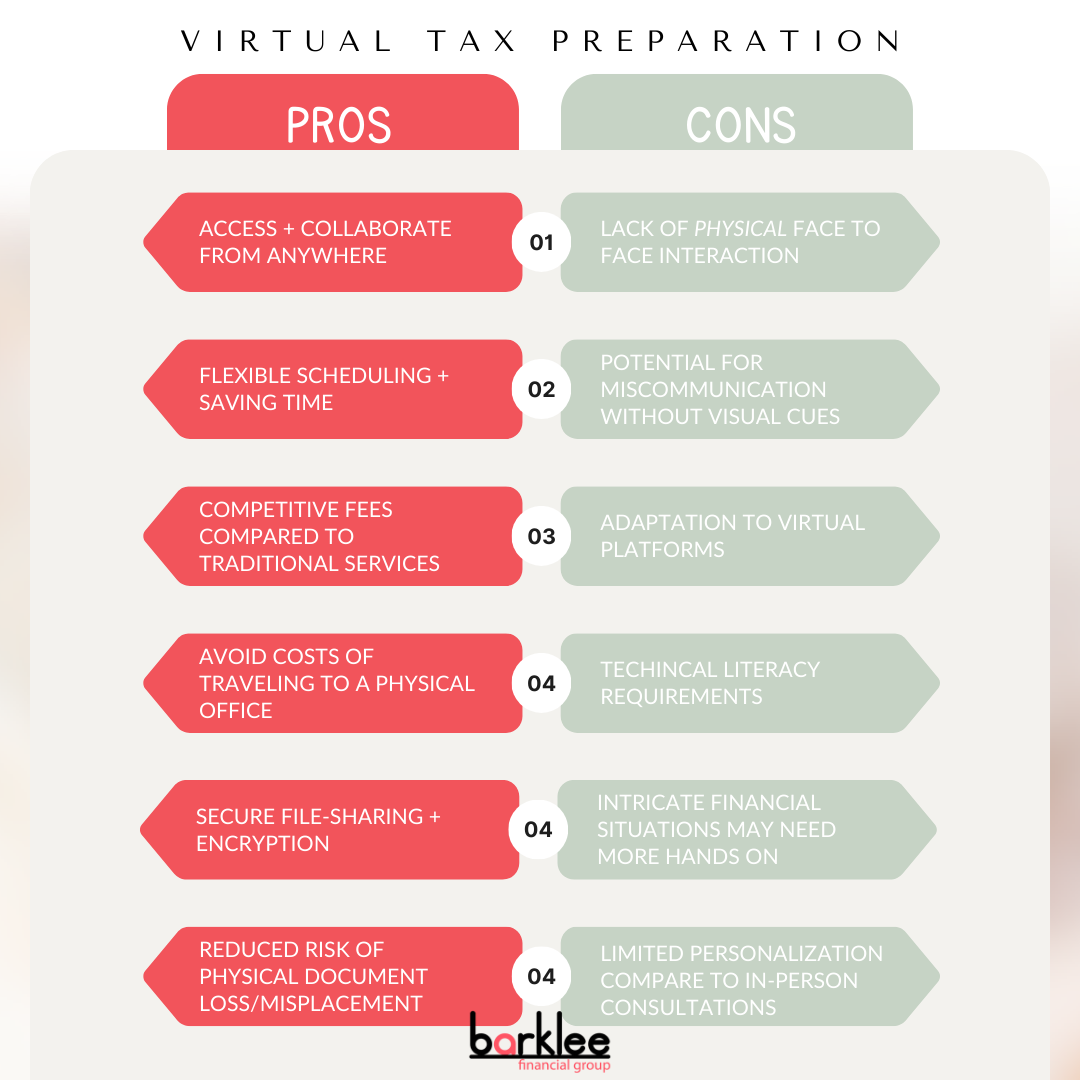

What Are the Pros and Cons of Virtual Tax Preparation?

In an era where convenience and efficiency are highly prized, virtual tax preparation emerges as a transformative solution for managing your taxes. This digital approach to tax preparation is redefining how individuals and businesses tackle tax season, presenting a new set of advantages and considerations.

Let's delve into the pros and cons of virtual tax preparation to understand how it might serve your financial needs and perhaps redefine your tax filing experience.

PROS

Convenience

- Access your tax preparer from anywhere with an internet connection.

- No need for in-person meetings, saving time and empowering individuals to connect + collaborate from anywhere in the world.

- Flexible scheduling allows you to submit documents and review returns at your convenience.

Cost Effective

- Often, virtual tax preparers have competitive fees compared to traditional services.

- Avoid travel costs and potential parking fees associated with visiting a physical office.

- Time savings translate to increased cost-effectiveness.

Enhanced Security Measures

- Secure file-sharing platforms and encryption ensure the protection of sensitive information.

- Reduced risk of physical document loss or misplacement.

- Real-time updates and notifications enhance security awareness.

CONS

Limited Face-to-Face Interaction

- Lack of in-person meetings may be challenging for those who prefer face-to-face communication.

- Building a personal connection with your tax preparer might be more challenging.

- Potential for miscommunication due to the absence of visual cues.

Tech Literacy Requirements

- Some individuals, especially older taxpayers, may find it challenging to adapt to virtual platforms.

- Potential learning curve for using online tools and electronic document submission.

- Dependency on technology may pose challenges for those less familiar with digital tools.

Complex Tax Situations

- Individuals with intricate financial situations may require more personalized, hands-on assistance.

- Virtual platforms may not be as effective in handling complex tax scenarios.

- Limited personalization in advice compared to in-person consultations.

Tips and Tricks for Working with a Virtual Tax Preparer

Clear Communication is Key

When collaborating with a virtual tax preparer, it is crucial to foster clear and transparent communication. Articulate your financial situation, goals, and any concerns with utmost clarity. Utilize email, messaging platforms, or video calls to maintain a consistent and open line of communication, and promptly respond to any inquiries or requests for additional information.

Organize Your Documents Efficiently

Simplify the virtual tax preparation process by getting your financial documents organized and categorized. Use secure file-sharing platforms to quickly upload and share the necessary files. Keeping a well-organized record of your income, expenses, and receipts will make tax preparation smoother and more accurate.

Leverage Technology for Convenience

Make sure to take advantage of the technological tools provided by your virtual tax preparer. Get familiar with the online portal, electronic document signing, and any other software they use. By embracing these technologies, you'll not only boost efficiency, but also make the most of the convenience that virtual tax preparation has to offer.

Be Proactive in Tax Planning

Apart from just preparing your taxes, make sure to have a conversation with your virtual tax preparer about proactive tax planning. Talk about possible deductions, credits, and strategies to optimize your financial situation for tax efficiency. Being proactive allows you to make informed decisions and could potentially save you money when it comes to your tax liability.

Review Your Return Thoroughly

Before finalizing your tax return, thoroughly review the documents provided by your virtual tax preparer. Ensure that all information is accurate and that you understand the details of your return. If you have any questions or concerns,

don't hesitate to seek clarification. A collaborative approach to the final review ensures that your tax return aligns with your financial goals and complies with relevant regulations.

Is it Safe to File Taxes Online?

Filing taxes online has become a widespread practice, offering convenience and efficiency.

However, it's understandable that many people have concerns about the safety of their sensitive financial information.

The good news is that reputable online tax filing platforms prioritize the security of your data. These platforms, often referred to as e-filing services, employ advanced encryption protocols similar to those used by banks. This ensures that your personal and financial details are transmitted securely over the internet.

Furthermore, reputable online tax filing services adhere to strict industry standards and regulations. For instance, the IRS has established a set of security standards that online tax software must meet. When selecting an online tax filing platform, look for certifications from recognized security organizations. These certifications indicate that the platform has undergone rigorous testing to effectively safeguard your data.

Filing taxes online is a safer alternative to traditional paper filing. Say goodbye to worries of lost or stolen documents during transit. With e-filing, you can minimize such risks. Online platforms often offer features like two-factor authentication, providing extra security.

By choosing a trusted online tax filing service and following best practices like creating strong passwords and securing your login information, you can confidently enjoy the benefits of a secure and efficient online tax filing experience. Get ready for peace of mind!

In summary, the world of tax preparation has experienced a significant transformation with the emergence of virtual tax preparation services.

The benefits offered by these services are undeniable, providing individuals and businesses with a convenient, cost-effective, and technologically advanced approach to meeting their tax obligations.

From the flexibility of accessing tax services anytime and anywhere to the streamlined processes facilitated by cutting-edge software, virtual tax preparation has become synonymous with efficiency in the digital era.

More Resources + How to Schedule a Conversation with

Barklee Financial Group

At Barklee, we believe in the power of knowledge and staying informed.

When it comes to choosing a virtual tax preparer, nothing is more important than being vigilant and making the right choice. This page is packed with tips, tricks, and invaluable insights to ensure a seamless and successful collaboration with a virtual tax professional.

If you're eager to dive deeper into Barklee's tax preparation services, look no further!

Just jump right in here.

Plus, if you're seeking guides and blogs tailored to your unique situation, whether it's partnership taxes or financial statements for sole-proprietors at tax time, we've got you covered. Sign up to get them sent straight to your inbox.